Digital wallets

Learn how tokenization works in Apple Pay and Google Pay.

Introduction

Apple Pay and Google Pay are mobile payment systems that enable secure transactions without the need for cash or physical cards.

While Apple Pay allows its customers to add credit or debit cards to the Wallet app on iOS devices, Google Pay does the same for Android devices.

Operation

Apple Pay and Google Pay operate through the technology of tokenization. When a credit or debit card is added to the Wallet application, the card information is encrypted and converted into a unique token that is securely stored on the device.

Let's go through the step-by-step process:

- Your customer adds their credit or debit card to the Wallet application on their device.

- The card information is encrypted and transformed into a unique token that is securely stored on the device.

- When your customer wants to make a transaction, they simply hold their device near a payment terminal that supports NFC technology.

- The device sends the token to the payment terminal instead of transmitting the actual card information.

- The card information remains protected and is not shared with the store or the financial institution during the transaction.

Provisioning decisions

When your customers attempt to add a card to Apple Pay or Google Pay, the provisioning process begins. This process involves generating and assigning a token to the sensitive card data.

At Pomelo, we have three possible responses for such requests: authorization, rejection, or a request for additional verification.

| 🟢 Authorization | The provisioning request is secure, without any risks, and we authorize it. |

| 🟡 Additional verification | We need additional information to authenticate the cardholder. Typically, we send a one-time password (OTP) for this purpose. |

| 🔴 Rejection | We have determined that it is not safe to grant the token. This usually occurs when a card is invalid, if the requested additional information is not verified, or if the card is blocked. |

The response will depend on the risk information and available recommendations. It is important to note that although the brand provides a suggestion, from Pomelo we make the final decision.

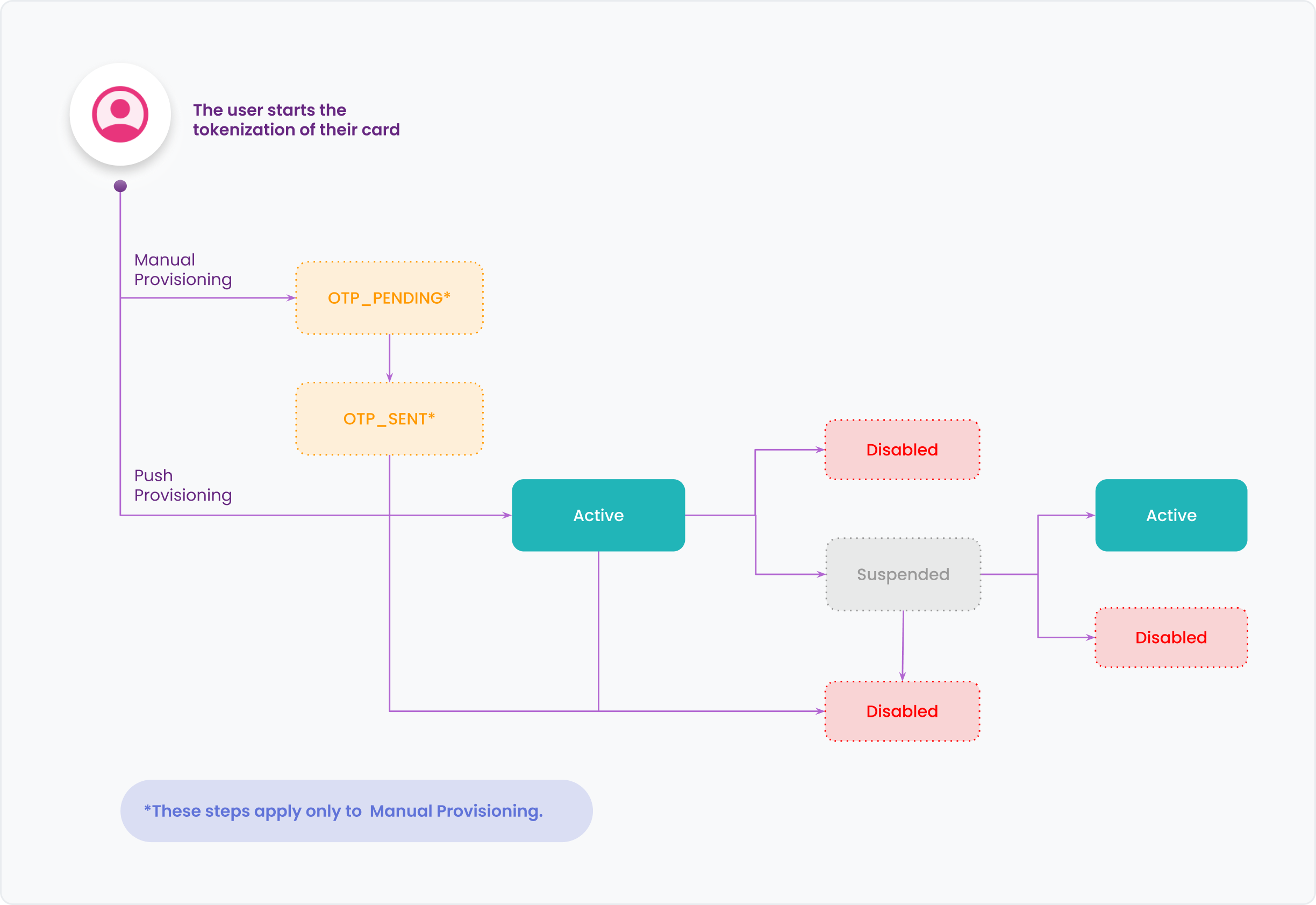

Tokenization status webhooks

You will receive real-time webhook notifications for the different lifecycle states of the token generated by your customers in digital wallets (Apple Pay, Google Pay).

Token status:

| Status | Description |

|---|---|

OTP_PENDING | The tokenization process requires OTP validation. The customer has not yet entered the code. (Applies only to Manual Provisioning) |

OTP_SENT | The authentication code (OTP) was successfully sent to the end user.. (Applies only to Manual Provisioning) |

ACTIVATED | The token has been activated and is ready to be used in tokenized transactions. |

SUSPENDED | The token has been temporarily suspended and cannot be used until reactivated. This may occur due to security measures or device management actions. |

DISABLED | The token has been permanently deactivated, either by the user, the issuer, or the wallet. |

For more details about the webhook structure, refer to the technical documentation.

Apple Pay and Google Pay Comparison

| Feature | Google Pay | Apple Pay |

|---|---|---|

| Availability | Available in more countries, including emerging markets. | Available in fewer countries, mainly in developed markets. |

| Device compatibility | Compatible with a wide range of Android devices, including smartphones and smartwatches. | Compatible with iPhone, iPad, Mac, Apple Watch, and select models of MacBook. |

| Operating System Integration | Built-in on Android. | Built-in on iOS. |

| Token storage | On Google servers. | On the device. |

| Ease of use | Easy to use, with an intuitive and accessible interface. | Easy to use, with an intuitive and accessible interface. |

| Data protection | It offers a high level of data protection and security through end-to-end encryption and two-factor authentication (2FA). | It offers a high level of data protection and security through end-to-end encryption and two-factor authentication (2FA). |

| In-store usability | Accepted at stores that support NFC-enabled debit and credit cards. | Accepted at stores that support NFC-enabled debit and credit cards. |